are charitable raffle tickets tax deductible

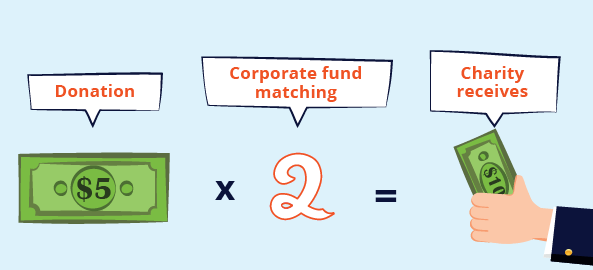

For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes. If the ticket purchaser pays an amount of money that exceeds the fair market value of what is received then this excess is what can qualify as a tax deductible charitable contribution.

Ticket Events Set Tax Deductible Amounts Givesignup Blog

If you donate property to be used as the raffle prize itself its value may be deductible as a charitable.

. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. Buying a raffle ticket to support a nonprofit organization is not a deductible expense.

This is because the purchase of raffle tickets is not a donation ie. You cannot deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. For example if the ticket price is 100 and the fair market value of the food andor entertainment received at the event is 25 per donor the portion of the ticket price that is deductible as a charitable contribution is 75.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Not all charities are DGRs. The organization may also be required to withhold and remit federal income taxes on prizes.

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket.

However many of these crowdfunding websites are not run by DGRs. Raffle Tickets may not be deductable when sold as charitable gifts from nonprofit organizations even if its in the nonprofit organizations name. Costs of raffles bingo lottery etc.

For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation. Are Charity Raffle Tickets Tax Deductible. Can i deduct the cost of raffle tickets purchased from non profit organizations.

However if you dont accept the ticket at the time of making the donation or send it back to the charity soon after receiving it you arent receiving a benefit and therefore the entire 100 price is deductible. Please consult your accountant or tax professional for further. Something additional to consider is that while you cant take a tax deduction from buying a charity raffle ticket.

Basically the IRS treats it like gambling or specifically nondeductible gambling losses because youre not selflessly donating to charity but rather playing the odds in hopes of receiving something of. Exempt under section 501 of the Internal Revenue Code. The donor must be able to show however that he or she knew that the value of the item was less than the amount paid.

The reason why is that you are gambling on the possibility of winning the drawing not donating. Per IRS pub 526 page 6 If you receive or expect to receive a financial or economic benefit as a result of making a contribution to a qualified organization you cant deduct the part of the contribution that represents the value of the benefit. Raffle Tickets even for a charity are not tax-deductible.

For example a charity may publish a catalog given to. For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution. If you accept the house in lieu of cash youll be responsible for ongoing property taxes which generally run up to 4 percent of the homes value depending on its location.

A tax-exempt organization that sponsors raffles may be required to secure information about the winners and file reports on the prizes with the Internal Revenue Service. If the amount of money paid or a ticket is equal to or less than the fair market value of what is received by attending the event then NONE of the ticket price can be considered a tax-deductible. When you purchase a book of raffle tickets from a charity you are receiving something of material value in.

The cost of a charity raffle. The IRS regulates games of chance too as well as the taxable income that is earned by victorious game-players. It may be deductible as a gambling loss but only up to the amount of any gambling winnings from that tax year.

Your state may or may not permit charitable nonprofits to conduct raffles Bingo auctions and other games of chance. Dues to fraternal orders and similar groups. When you accept the ticket but choose to not attend the dinner however the tax rules treat your acceptance of the ticket as a 40 nondeductible benefit since possession of it still.

Raffles are considered contributions to which you benefit by the IRS. The portion of the admission or ticket price that equals the value of goods or services the donor receives at the event is not deductible. This means that purchases from a charity that involve raffle tickets items or.

Are Nonprofit Raffle Ticket Donations Tax Deductible. For information on how to report gambling winnings and losses see Deductions Not Subject to the 2 Limit in Publication 529. For specific guidance see this article from the Australian Taxation Office.

The cost of a charity raffle ticket is not tax deductible. Unfortunately fund-raising tickets are not deductible. There is the chance of winning a prize.

Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets. If it does it is likely your nonprofit will need to apply for a license from the state beforehand. The irs doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. Raffles tickets are not deductible expenses if you help a nonprofit organization with them.

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Bundling Can Provide Tax Advantages Catholic United Financial

Deadline Approaching October Home Bmw Raffle Prize Drawing Norton Children S Louisville Ky Raffle Prizes Hospital Childrens Hospital

What Is A Tax Deductible Donation To A Nonprofit Organization Nonprofit Startup Nonprofit Fundraising Non Profit Donations

Tax Deductible Donations An Eofy Guide Good2give

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Are Raffle Tickets Tax Deductible The Finances Hub

Charitable Deductions On Your Tax Return Cash And Gifts

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Non Cash Donation Donation Letter Donation Request Letters Fundraising

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic S Blog

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Template Donation Letter Donation Thank You Letter