unfiled tax returns reddit

Unfiled Tax Returns. It is common that a non filer will have more than one unfiled tax return and that the non filing period may span over.

Immigration And Lying On Your Tax Return The Quickest Way To Deportation Verni Tax Law

We just mailed all the returns.

. I had unfilled taxes from 2009 to 2016. The irs says you shouldnt use the new. You start by collecting all your W-2s 1099s and any other income documents you have.

Hello Im almost ready to apply for my CPA license with all exams passed in NY. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you.

Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. If your return wasnt filed by the due date including extensions of time to file. If you dont have some go to IRSgov set up an account request transcripts for incomewages.

However I ironically have a few years of tax returns that I didnt submit mostly because I was. A non filer is a taxpayer who has an unfiled tax return. However I ironically have a few years of tax returns that.

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. That is because those people typically receive a 1099 form the government will use instead. Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20.

I havent filed since then either because it felt insurmountable and just gets worse with time. This means that while you cant be put in jail for not filing a 1988 tax return you will forever owe the IRS a returnas long as you earned enough to have had an obligation to. He told me once.

Whether You File Your 2022 Tax Returns Online Or In-Office We Can Answer Your Questions. Whether You File Your 2022 Tax Returns Online Or In-Office We Can Answer Your Questions. I didnt file income tax either CA or federal one year probably 2009.

However you may still be on the hook 10 or 20 years. Hello Im almost ready to apply for my CPA license with all exams passed in NY. Applying for CPA license with unfiled tax returns.

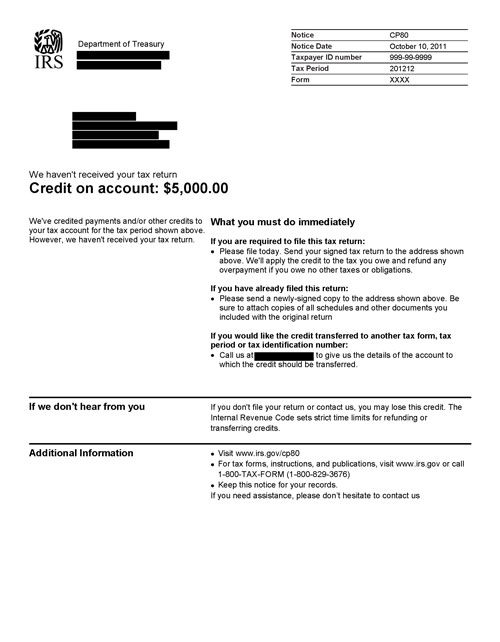

Introduced in the 2019 tax year this form is officially titled US. You can get a tax return rejected by the IRS for several reasons such as a misspelled name inaccurate information on a dependent or entering an incorrect date of birth. Due to processing delays for 2019 and 2020 tax returns the issuance of CP80 and CP080 Unfiled Tax Return Credit on Account notices has been suspended the IRS said.

Now the Franchise Tax. Havent filed taxes in 10 years reddit. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

They were recently done by a tax pro I was referred to. FYI if your debt is from tax year 2010 and you filed on time in 2011 you might be getting close to the Collection Statute Expiration Date CSED. If so then you may be able to use Form 1040SR to complete your senior tax return.

Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. The IRS only has ten years to collect on tax debt. Total bill is about 13k.

Tax Return For Seniors.

/cloudfront-us-east-1.images.arcpublishing.com/gray/7IV55M2OM5ADNKKQ6YIU4DTFA4.png)

Received A Confusing Tax Letter Here S What Experts Say You Should Do

Irs Tries To Reassure Pandemic Panicked Taxpayers

Irs Suspended Mailing Its Bad Notices For Now But You Can Still Be Penalized What To Know Reporterwings

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

What To Do If You Receive A Missing Tax Return Notice From The Irs

Irs Tries To Reassure Pandemic Panicked Taxpayers

Transferring Property To Avoid Paying The Irs Taxes Verni Tax Law

How To Fill Out A Fafsa Without A Tax Return H R Block

Irs Notice Cp2000 What Is It Massey Company Cpa Atlanta

Common Irs Audit Triggers Bloomberg Tax

Irs Tries To Reassure Pandemic Panicked Taxpayers

Applying For Cpa License With Unfiled Tax Returns R Tax

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

10 Years Of Unfiled Taxes R Tax

:max_bytes(150000):strip_icc()/anthem_tax_services_gradient_transparent-03-01-10f2e88fe6914a4fb1e8221ba8b1ac62.png)

The 7 Best Tax Relief Companies Of 2022

Forgot To File Taxes In 2013 And Irs Just Notified Me In 2020 R Tax

I Received This Letter Today From The Irs I Talked To The Tax Advocate Thursday R Irs